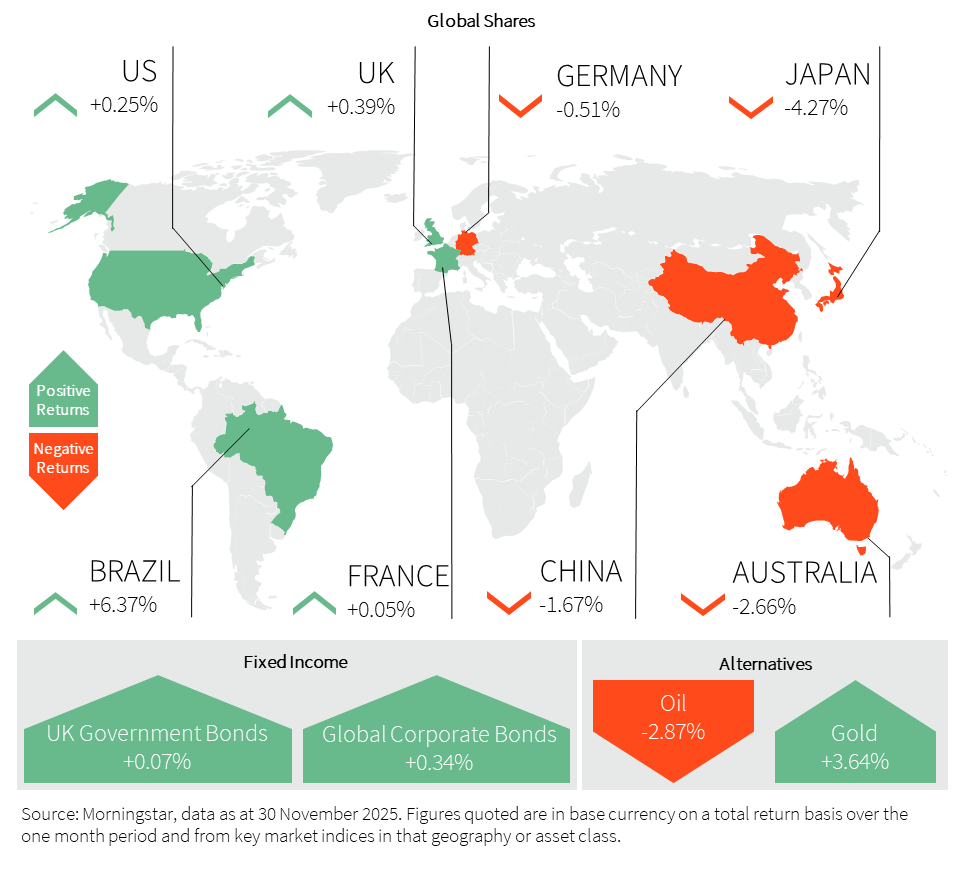

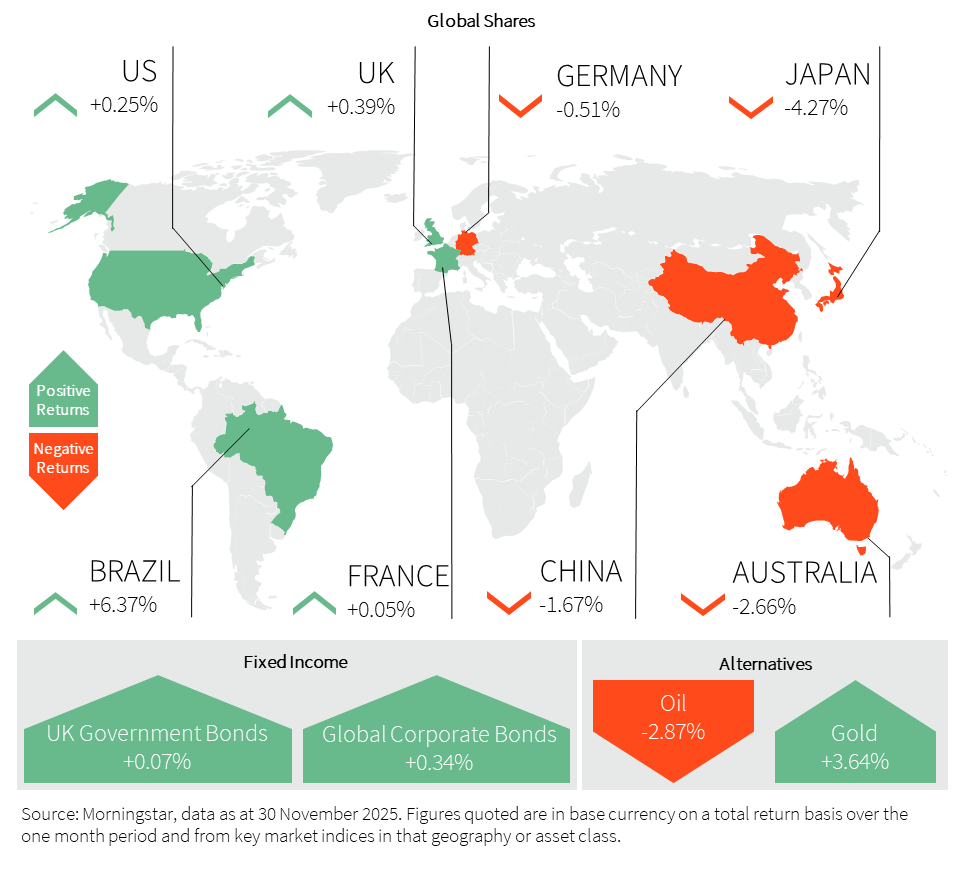

Global Market Insights – November 2025

Summary Although historically the best month for equity markets, this November saw global stocks sell off amidst a spike in volatility driven by fears of an AI bubble. The sell-off…

Read more ›The day-to-day investment decisions will be made by our experts, allowing us to act quickly and take advantage of undesirable risks such as market timings and opportunities as they arise.

We make sure you aren’t paying more tax than you need to, taking advantage of Income, Capital Gains and Inheritance Tax allowances. We will also use ISA’s, Pensions and Offshore Bonds as well as utilising Business Relief exemptions.

We have a dedicated Research Department producing company notes, sector notes, regular commentary, and extensive market research.

A dedicated specialist Investment Manager will work with you to fully understand your investment objectives, time horizon and risk appetite. They will then actively manage your investments based on those parameters. The service also allows us to factor in any ethical requirements, cherished holdings, and provides options for income and management of Capital Gains Tax. The Investment Manager will make investment decisions on your behalf within your agreed Investment Management Plan.

Managed by our Research Department, this service is designed to provide a diverse, actively managed investment solution. The model portfolios are benchmarked against the respective Investment Association sector average with a choice of two approaches, both operating within your risk appetite. Our Wayfarer portfolios have an absolute return focus over an economic cycle, whereas our Navigator range aims to deliver benchmark like returns with lower volatility.

Access to a dedicated Investment Manager to manage your investments, ensuring a suitable strategy remains in place to meet your objectives. | |

Access to a specialist Financial Planner providing a tailored & tax efficient plan for life’s events; including retirement, inheritance tax planning and lifestyle protection. | |

Secure 24/7 web access to track your investments | |

Secure custody facilities for the safekeeping & administration of your investments | |

Flexible ISA tax wrapper at no extra cost | |

Regular income payments either to your nominated bank account or to your portfolio for reinvestment | |

An annual tax package including capital gains computation and consolidated tax certificates |

In the recent Aon client satisfaction benchmark survey for 2020, we came first for Financial Planning satisfaction alongside 11 competitors.

82% of our clients are overall satisfied with the service they are receiving from us.

Summary Although historically the best month for equity markets, this November saw global stocks sell off amidst a spike in volatility driven by fears of an AI bubble. The sell-off…

Read more ›

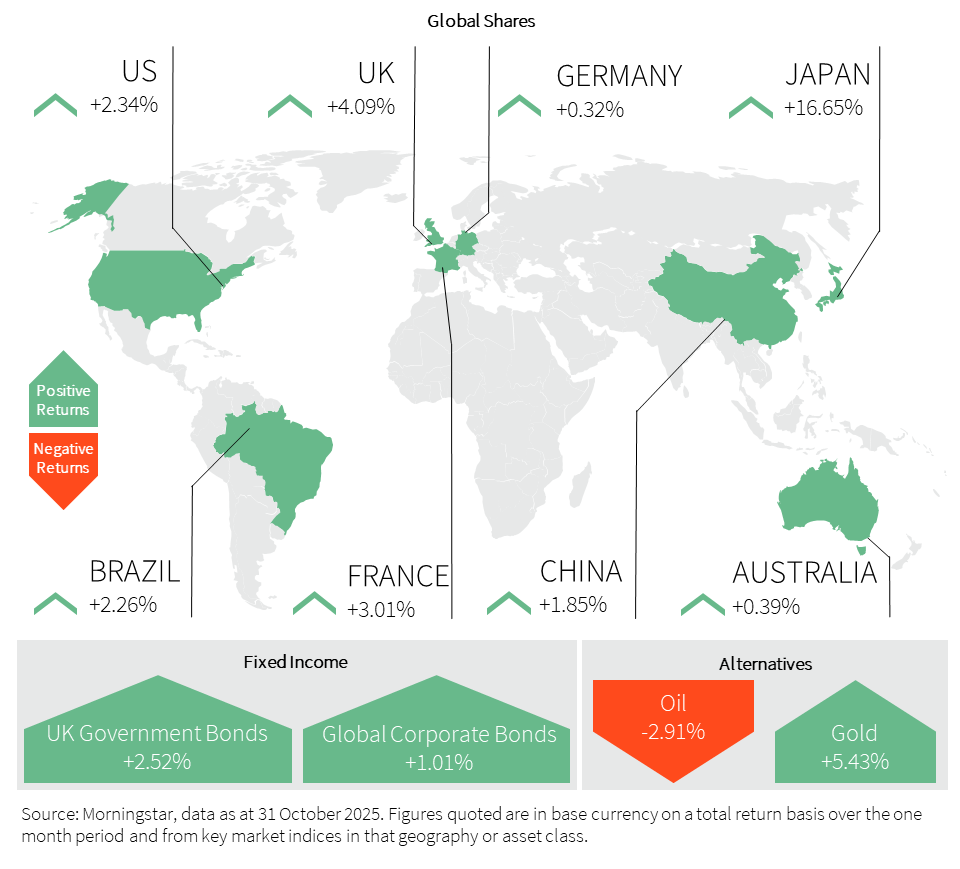

Summary October proved to be another lucrative month for market participants. Despite gold registering its largest intra-day decline in over a decade, the precious metal is yet to lose its…

Read more ›

Macro Global economic data was mixed in Q3, with strength in August waning as we moved into September, and the majority of Purchasing Managers Indices (PMI) weakened. Gross Domestic Product…

Read more ›