Wayfarer Commentary: Q3 2025

Macro Global economic data was mixed in Q3, with strength in August waning as we moved into September, and the majority of Purchasing Managers Indices (PMI) weakened. Gross Domestic Product…

Read more ›Tax is one of the biggest concerns when transferring wealth to the next generation. Without careful planning, HM Revenue and Customs could be the main beneficiary of your estate, and many are not aware of the main taxes, the reliefs and solutions available.

Protecting and preserving your wealth is at the core of what we do; we will provide suitable recommendations that will assist you in meeting your financial goals and ambitions.

Placing assets into a trust is a safeguarding option to ensure assets are reserved for a particular beneficiary, such as a family member, rather than being spent. Once a trust is setup, you are no longer their owner – the trustees are – and the assets are not treated as part of your estate, meaning that after a qualifying period, they will not be subject to Inheritance Tax when you die.

Trusts can be used for many purposes. We can advise on whether a trust is the best option for you, or if alternative options may be more suitable for your individual circumstances.

The service is operated on a discretionary basis, meaning it is actively managed on your behalf by our specialist investment managers who invest in growth stocks, constantly monitoring them to ensure that they qualify for Business Relief.

Before receiving advice upon death, the family will be faced with:

After planning received via WH Ireland Mary then passes away just over 2 years later. Let us assume the IHT investment has grown by 6% net of fees.

The family are now faced with:

In the recent Aon client satisfaction benchmark survey for 2020, we came first for Financial Planning satisfaction alongside 11 competitors.

82% of our clients are overall satisfied with the service they are receiving from us.

Macro Global economic data was mixed in Q3, with strength in August waning as we moved into September, and the majority of Purchasing Managers Indices (PMI) weakened. Gross Domestic Product…

Read more ›

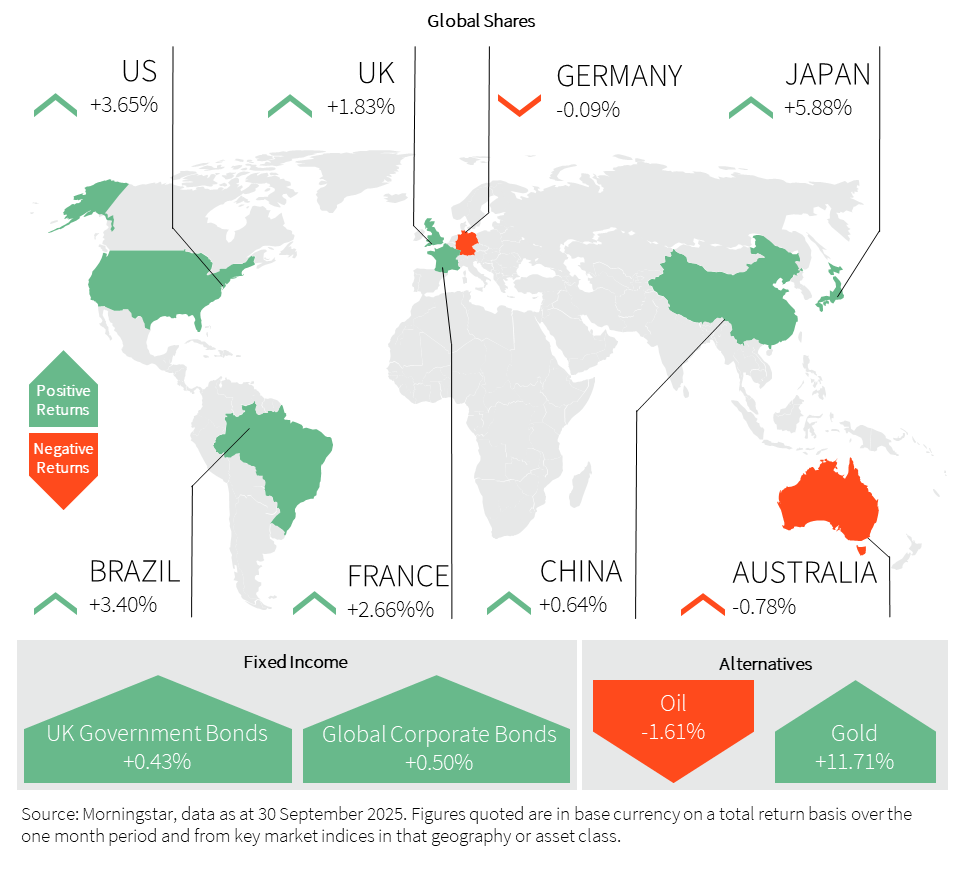

Summary Global markets gained nearly 4% in the month, led by strong performances from the US and Emerging Markets. The lack of retaliation to US tariffs and ongoing trade diversion…

Read more ›

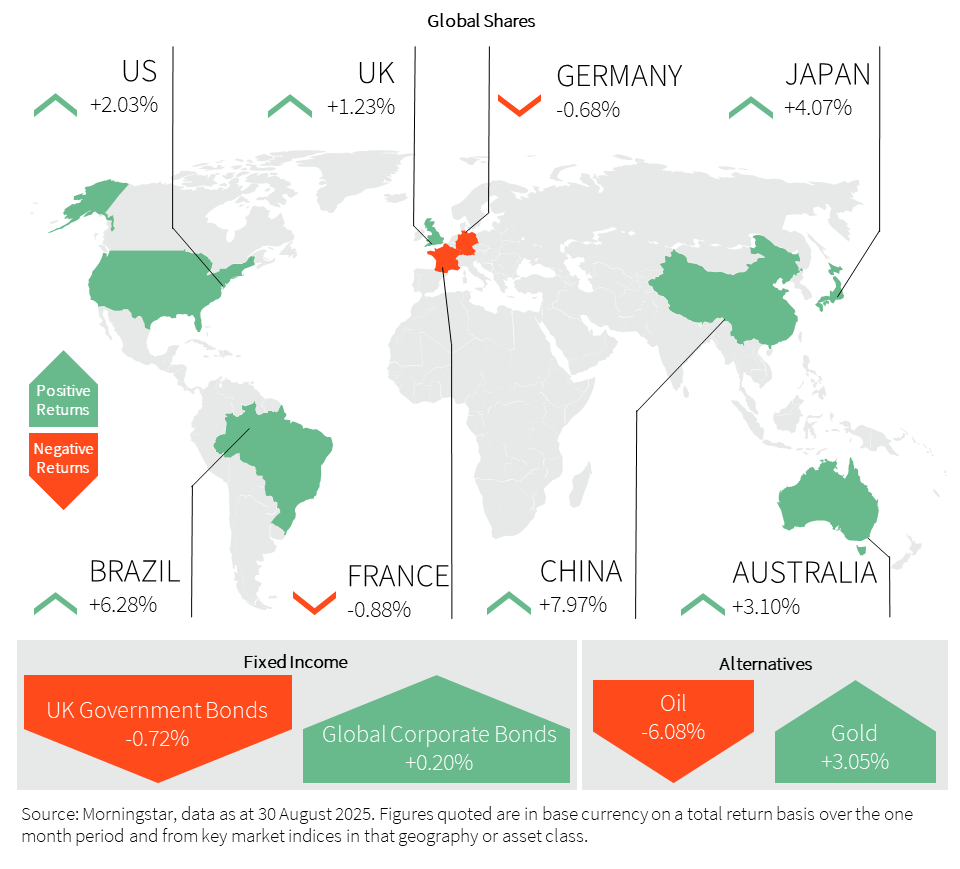

Overview August was characterised by slowing momentum, with markets fearing that the AI ‘bubble’ is bursting, but Federal Reserve Chair Powell’s speech in Jackson Hole helped markets to shake it…

Read more ›