Wayfarer Quarterly Commentary – Q4 2025

Macro As in the previous quarter, economic data was mixed in Q4, and the picture was made murkier by the longest US government shutdown in history, which limited data availability.…

Read more ›Whether you are looking to save, invest, or create a financial plan, we can help you achieve your goals.

LEARN MORE →We can help you make the most of a lifetime of hard work by planning for the retirement you want.

LEARN MORE →Secure your family’s financial future with our help.

LEARN MORE →We specialise in providing a tailored and personalised financial plan for our clients, created with your goals in mind.

Our recommendations will always consider what is most suitable for you, whether that be one of our own investment services or a third-party solution.

We offer you an overall cost saving by itemising our management and custody charges separately, which means we are able to offer our custody charge VAT-free.

At your first meeting, we will discuss what your goals are, establish your objectives and your appetite for risk. Following this, we will review what you have, what you need, and the best options for you.

We will talk you through our recommendations, including our costs and charges, explaining how it works for you both now and in the future.

We firmly believe that effective financial planning requires regular monitoring and reviews, so this won’t be the last you hear from us. We will continue to make sure your plan is kept on track and altered as necessary in line with any changes to your needs, as well as market conditions.

In the recent Aon client satisfaction benchmark survey for 2020, we came first for Financial Planning satisfaction alongside 11 competitors.

82% of our clients are overall satisfied with the service they are receiving from us.

Macro As in the previous quarter, economic data was mixed in Q4, and the picture was made murkier by the longest US government shutdown in history, which limited data availability.…

Read more ›

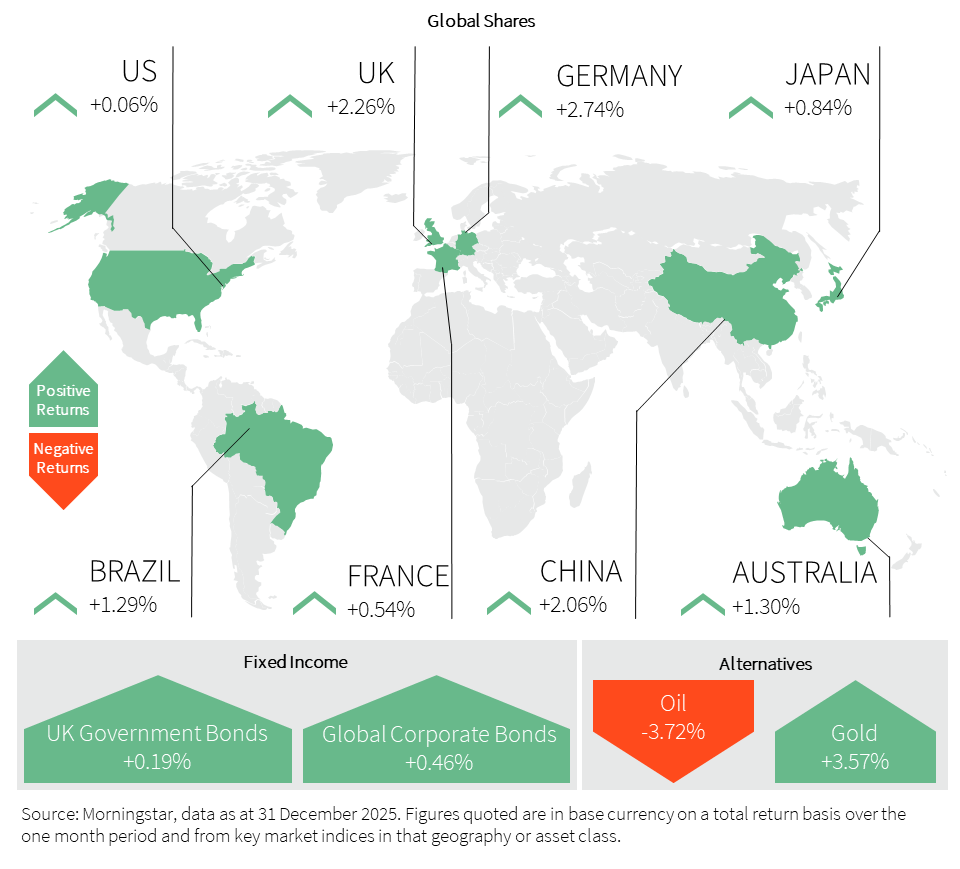

World Market Summary December was characterised by growing geopolitical tensions alongside regional divergence in economic growth trends and market performance. Europe led with a 2.7% gain, while the FTSE 100…

Read more ›

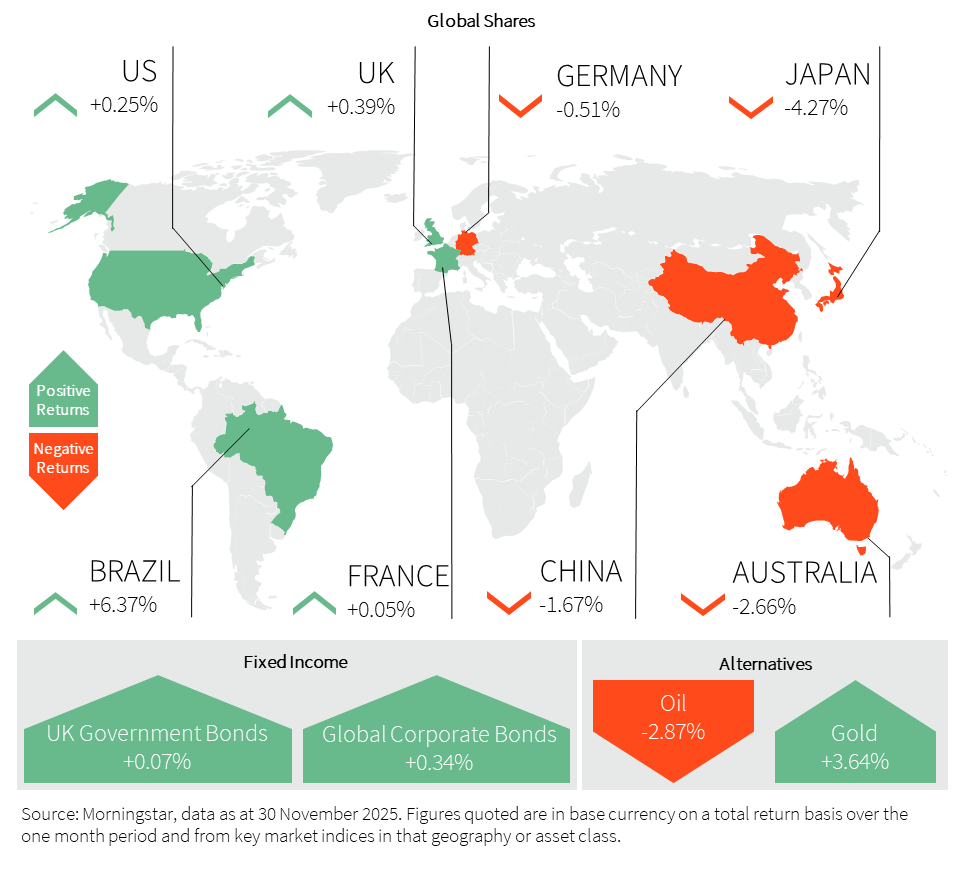

Summary Although historically the best month for equity markets, this November saw global stocks sell off amidst a spike in volatility driven by fears of an AI bubble. The sell-off…

Read more ›